EQWITY. Overview ICO

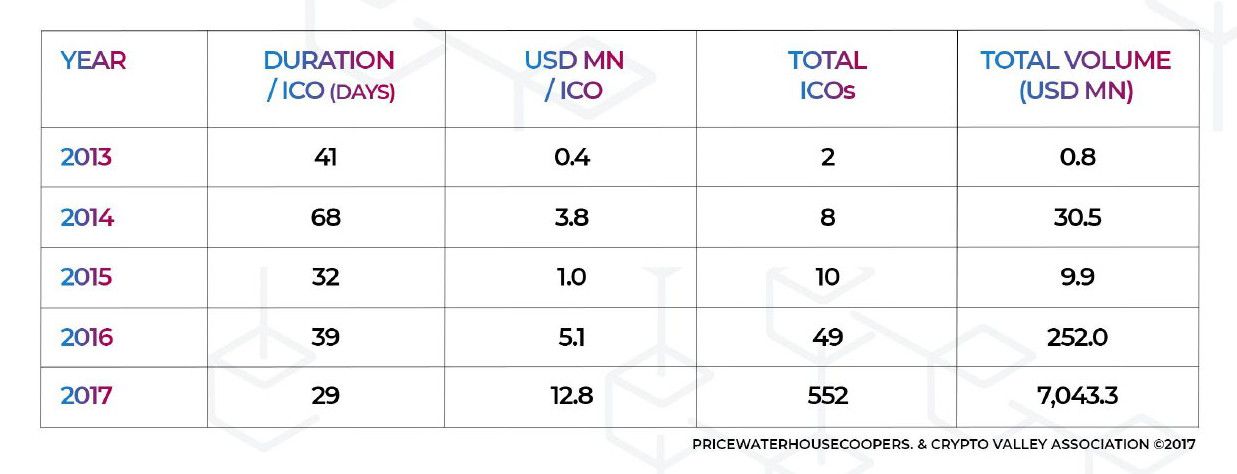

Today, many startups thanks to ICO have the opportunity to declare themselves and offer services related to blockchain technology. During the past “bullish” years, 209 cryptocurrencies and tokens were created with the help of ICO, and their creators were able to attract investments of $ 5.6 billion, which was a record for that time.

In 2018, despite a strong market downturn, the number of ICO broke new records. In the seven months of this year, 638 ICOs were held in the amount of $ 17 billion.

But unfortunately, ICO has not only obvious advantages, but also significant drawbacks. Below we take a closer look at them, and also tell you how the EQWITY team is going to solve them.

Common ICO Market Problems

• SCAM - a real scourge for the ICO market. According to various estimates, the share of fraudulent projects in the total volume of ongoing ICO projects can reach an impressive 78%.

• Lack of rights - investors invest in start-ups, and at the same time they have neither shares of companies, nor dividends, nor voting rights. Thus, investors are deprived of the opportunity to influence decision-making by the founders and management of companies.

• Unverified founders - currently there is no clear mechanism for verifying the identity of founders of companies conducting ICO. Scanned copies of passports are easy to fake with the help of modern graphic editors, which fraudsters actively use. The creation of fake LinkedIn profiles, which are positioned as a reliable source of business information, is also actively practiced.

• High probability of failure - hundreds of projects that have collected millions of investments are now dead. Some did not go to any stock exchange, others did not submit a working product. According to the most modest estimates, the volume of funds attracted by unsuccessful projects is more than $ 100 million.

• Hacker attacks - more than 10% of the funds raised as a result of ICO in 2017 were stolen as a result of hacker attacks. In monetary terms, this amounted to 3.7 billion dollars.

• Lack of experience and qualifications - many companies are characterized by low quality projects, lack of entrepreneurial experience, insufficient developer qualifications and a precarious financial situation.

• Government regulation - many governments are trying to restrict or even ban an ICO. According to them, chaos and anarchy reign in this industry, creating ideal conditions for fraudsters, the mafia and money laundering.

• Money laundering - many companies refuse to implement the AML procedure, which negatively affects the fight against illegal money laundering.

• High barriers - today the cost of starting an ICO ranges from 100,000 to 500,000 USD. Thus, unequal conditions are created for the participants, and often startups with a good idea, but without starting capital, do not have the opportunity to hold an ICO.

EQWITY Ecosystem

The EQWITY team has developed a tool called ICO.E, a new ICO standard that provides two-way interaction based on transparency and trust between project founders and investors. It will also include a new model for auditing projects called “Proof of Viability” (PoV). This new standard aims to eliminate existing ICO problems, but does not affect its strengths.

EQWITY also offers a new identification mechanism. Today, only investors are forced to undergo the KYC procedure, but the risks of fraud for investors by the founders of companies are much higher. Therefore, EQWITY additionally introduces KYF (Know Your Founders). KYF will include identification of the founder’s identity, background biographical data verification and police records of criminal records and offenses. KYF will be conducted by an independent third party, and the test results will be publicly available to investors.

To protect the rights of investors, EQWITY implements a mechanism for distributing company shares among investors when purchasing token projects. The presence of shares in the hands will give the investor the right to vote in the decentralized management of the company, as well as the right to receive dividends and funds in the event of the sale of the company.

For the screening of potentially failed projects, a mechanism of decentralized audit - Proof of Viability (PoV) will be used. Each submitted project will be divided into component parts - a team, product quality, marketing, tokenomics, etc. To check the project components, a decentralized network of auditors with a mechanism to protect against fraud and manipulation by auditors will be created. At the first stage, each part of the project will be evaluated independently, at the second stage, the entire project is assessed. Audit results will be publicly available.

Thus, EQWITY technologies will minimize the risks of fraud on the part of project founders, as well as eliminate the imbalance between investors and founders, giving investors more rights and control over the development of projects.

Block type: EOS

Symbol token: EQY

Offer: 6 250 000 000 EQY

Price: 1 EQY = 0.01 USD

KYC: yes

Sales tokens: 3 125 000 000 EQY

Soft cap: 6 000 000 USD

Hard cap: 16 000 000 USD

Minimum investment: 0,1 ETH

Private Sale: 08/11/2018 - 11/11/2018

Pre-Sale: 17/11/2018 - 23/11/2018

Public Sale: 29/11/2018 - 29/01 / 2019

Website: https://www.eqwity.io/

White paper:

https://www.eqwity.io/wp-content/uploads/2018/10/Eqwity_WhitePaper_ENG_1.0.pdf

Twitter: https://twitter.com/eqwity_official

Facebook:https://www.facebook.com/Eqwity-925774120955061

Telegram:https://t.me/Eqwityl

Medium https://medium.com/@eqwity.official

Autohor: Jeaniever Rahardian

ETH addres : 0x42836bf737eC833228344f0841C3bD14f4D67643

Comments

Post a Comment